Debt and assets: how do councils determine the right level of debt?

One of the major questions all councils grapple with is how to pay for capital expenditure – what proportion should be paid by operational income and what proportion should be paid for by debt, whether by bank loan or bond.

In answering such questions councils apply the principle of inter-generational equity, which requires that each generation that benefits from an investment, such as an investment in a waste water plant that is expected to serve a community for at least 50 years, should contribute to the cost of that service. One way of doing this is to borrow the cost of the construction of the plant and pay it off during its operational life time, ensuring that each generation which benefits also contributes.

But how much debt can a council afford?

Councils employ a range of quantifiable thresholds so as to ensure debt levels remain sustainable. The Local Government Act 2002 requires councils to set, in consultation with citizens, financial strategies which include a statement of the local authority’s quantified limits on rates, rate increases and borrowing. Financial strategies also outline expected capital expenditure on network infrastructure. In addition they must also adopt ‘revenue and financing’ policies which dictate how capital expenditure will be funded and ‘liability management’ policies, which set interest rate exposure, liquidity, credit exposure and debt repayment approaches. Councils must also balance their budgets on an accrual basis unless it is prudent not to.

In order to assess whether councils are managing their debt levels, LGNZ asked NZIER to look into the question of whether local government was fiscally responsible or not, with particular emphasis on debt. NZIER commented:

Local government is generally obliged to balance their budget so debt is not used to fund operational expenditure. This is underpinned by the ‘Golden Rule’ of fiscal policy. The Golden Rule suggests that Government should only borrow to invest (in relation to local government this refers to investment in infrastructure, such as waste water schemes, rather than stocks and shares) and not to fund current spending. This is consistent with intergenerational equity in that any debt inherited by future generations is matched by assets passed on. Debt can be used by local government to spread the cost of long lived assets across generations.

As a result of the sharp increase in capital spending since the mid-2000s, the sector is making more use of debt. The level of debt is not the problem though. The problem is whether or not the local government sector can deal with the amount of debt it has. To get an understanding for that, two measures can be used; the Gearing ratio – comparing debt to total assets (and) the Interest Cover ratio – comparing the interest being paid on debt with the revenue stream.(See http://www.lgnz.co.nz/assets/Uploads/NZIER-Is-local-government-fiscally-responsible.pdf.)

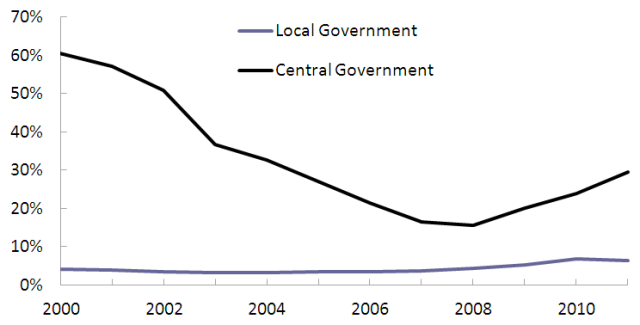

NZIER note that while the gearing ratio has been trending slowly upwards since 2000. As of 2010, the gearing ratio sat at 6.8 per cent, which compared with 30 per cent for central government (see figure 1). (The gearing ratio for 1992 stood at 8 per cent.) NZIER concluded that the level of local government expenditure financed by debt does not appear worryingly high.

Figure 1: Gearing ratio: debt to assets (Source NZIER 2012)

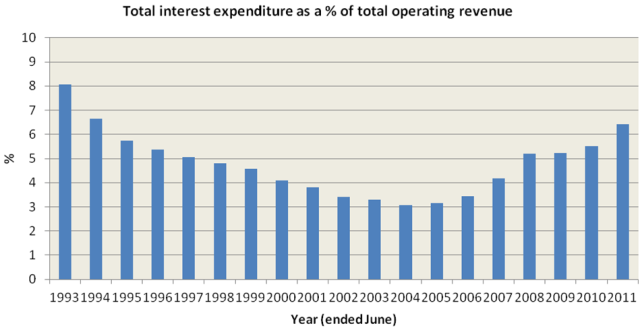

In relation to the interest cover ratio, NZIER found that councils were consistent with the Golden Rule, with the ratio of revenue being spent on debt servicing in 2011 sitting at 6.4 per cent, see figure 4 (provisional figures for 2013 put the figure closer to 8 per cent). Coincidentally, the Local Government Funding Authority, when assessing funding applications from councils, sets its maximum benchmark for debt servicing at 20% of total revenue.

Figure 2: Interest cover ratio

Why do councils use debt?

In their report on local government funding in 2007 the Local Government Rates Inquiry recommended that “local government look favourably on making more use of debt to finance long-term assets” (Inquiry 2007 p. 21). International research backed the Inquiry’s recommendations by showing that councils in both New Zealand and Australia had comparatively low levels of debt when compared to councils in the rest of the world (UCLG 2011).

Councils primarily borrow to fund capital investments, such as the building of infrastructure and amenities that benefit current and future generations. Debt is one way of smoothing the cost of construction over the generations that make use of, or benefit from, the service. It is a way of meeting the principle of ‘inter-generational equity.’

Inter-generational equity occurs when the costs of an asset are spread over the life-time of that asset and paid for by the generations that benefit from, or consume, that asset. Not only would it be unfair if today’s generation paid the full cost of building assets that last for 50 to 100 years, but such investments also tend to be well beyond the capacity of councils to fund out of their operational income alone.

Local authorities use debt to fund long-life assets. As a general principle, debt should not be used to fund operations. Furthermore, local authorities usually use debt to fund new assets to meet demand or to increase levels of service, rather than using debt to fund renewals (Office of the Auditor General 2012).

Unlike central government (which is free to borrow to fund operational expenditure and will often do so during a recession) councils generally borrow for capital investment. Because the law requires that they balance their budgets any council that borrows to ‘pay for the groceries’ is likely to be asked to justify its decision during the audit of its annual report.

How much debt do councils have?

The most recent figures on current and future council debt were compiled by the Office of the Auditor General (OAG) and published in its report to Parliament in November 2012. OAG’s analysis of councils’ Long Term Plans (LTP) showed that:

- the gross debt for local authorities was $9.8 billion in 2011/12 and is expected to rise to $18.7 billion in 2021/22;

- five of the 77 local authorities forecast no debt during the 10 years of their LTP;

- debt is significantly influenced by Auckland Council’s group debt which is forecast to reach $12.5 billion in 2021/22;

- total debt for all other local authorities is forecast to increase from $5 billion to $6.2 billion in 2017/18 and then drop to $6.0 billion in 2021/22; and

- many local authorities are looking to reduce their debt in the later years of the LTP.

OAG notes that while total debt will grow significantly over the coming ten years almost all of that growth is directly attributable to the unavoidable cost of putting in place infrastructure to cater for the rapid population growth faced by Auckland.

Where do councils borrow from?

Until the enactment of the Local Government Amendment Act No. 3 1996 (LGAA3) councils could only borrow from the Local Government Loans Board. The LGAA3 changed this situation by allowing councils to borrow directly from the market. Councils generally borrow from banks or issue local bonds.

More recently, following a joint central local government initiative, the Local Government Funding Agency (LGFA) was established. The LGFA issues its own bonds and is able to lend at interest rates below those charged by the major financial institutions, allowing councils that qualify to reduce their annual interest payments.

Councils are unable to borrow in international currency, however this restriction does not apply to either the Auckland Council or the Local Government Funding Agency.

Can councils borrow as much as they like?

No councils are required by law to set a debt limit in consultation with their citizens and it is the responsibility of the Office of the Auditor General to ensure that debt limits are prudent (as required by law). Any council acting imprudently in its use of debt is likely to be noted in the OAG’s annual report to Parliament.

Councils with relatively high levels of debt may find the cost of borrowing increases to reflect their risk profile. For example, the LGFA will generally only lend to councils if the proportion of their income spent on interest payments is less than 20 per cent. This is one reason why councils take their credit ratings so seriously.

There are no firm rules that specify a prudent debt level; it depends on the circumstances of each council. Some councils, such as those with growing populations, have the capacity to service higher levels of debt than others. ‘Growth’ councils, for example, have no alternative but to borrow as infrastructure services need to be in place before the arrival of new residents. Many use development contributions to repay loans used to develop the necessary infrastructure.

Is there a right way to measure debt?

One of the difficulties we face when analysing council debt is the range of different of measures employed. Commonly used measures are:

- the amount of interest paid annually as a proportion of total revenue;

- the level of debt (gross or net) as a proportion of total revenue;

- the amount of interest paid annually as a proportion of total rate income;

- the amount of interest and debt repayments as a proportion of either total revenue or rates income;

- the ratio of total debt (net or gross) to total assets;

- the dollar amount of debt per resident; and

- the dollar amount of debt per rating unit.

Not all measures are equally meaningful. A commonly used measure in the international literature is ‘interest payments as a proportion of total revenue’. If the proportion is too large there is a risk that resources spent on interest payments will not only ‘crowd out’ spending on other services but expose a council to risk from unexpected shocks. As an example of a practical benchmark, the LGFA requires that, in order for councils to qualify for loan finance, they spend less than 20 per cent of their total revenue on interest payments.

Often councils use a combination of measures. Auckland Council, for example, has set a target in its financial strategy that net debt should be less than 275 per cent of total revenue. In addition it has two other targets:

- that net interest to total revenue will be less than 15 per cent; and

- that net debt will be less than 25 per cent of rates income.

As noted above, for the local government sector as a whole interest payments as a proportion of total revenue were 6.4 per cent in 2011, well under generally accepted benchmarks (NZIER 2012). However, councils differ. OAG noted in its report on the 2012/21 LTPs that a handful of councils were close to their prudential limits.

How much do councils owe relative to what they own?

Local government debt is used to purchase or build infrastructure and assets, so the ratio of debt to assets is important to ensure the ongoing viability of councils and as a signal as to whether debt is being managed prudently. Lenders, however, are primarily interested in a council’s ability to service its loans.

At the 2009 Jobs Summit councils were described as having ‘lazy balance sheets’. The phrase lazy balance sheets referred to the low level of council debt in relation to the value of their assets. At the time councils owned assets worth nearly $100 billion dollars but had debt of less than $6 billion dollars – the equivalent of a $6000 mortgage on a $100,000 house. Conference organisers argued that councils had the ability to borrow more in order to bring forward infrastructure investment and thus help stimulate local economies at a time when the great financial crisis (GFC) was starting to take effect.

The level of local government financed by debt does not appear worryingly high from this data. Such a gearing ratio also does not look high compared to, say, the NZX-listed property sector (also carrying long term physical assets), which typically have a gearing ratio of around 30 per cent (NZIER2012).

Figure 1 shows total debt as a proportion of total assets for both local and central government – this is described as the ‘gearing ratio’. The proportion of debt to assets for local government currently sits well below 10 per cent although this is expected to rise. The OAG estimate that in 2022 the proportion of debt to assets will reach almost 12 per cent, assuming the proposed capital works programme for Auckland City goes ahead. Against all accepted benchmarks the level of local government debt is well within internationally accepted prudent levels.

Is local government debt sustainable?

Questions are frequently asked about whether or not councils have too much debt and are fiscally sustainable. Recent reports that councils have had operating deficits since 2007 have reinforced these concerns. Some concerns reveal a mis-understanding about the nature of the local government financial reporting framework. Unlike central government, which is able to borrow to cover its operating deficit, councils are required to balance their budgets. Borrowing occurs primarily to invest in new or upgraded infrastructure.

The deficits reported by Statistics NZ represent decisions councils have made to reduce the funding of depreciation. In certain situations such decisions are made because it is prudent to do so, for example, when infrastructure is new it is probably prudent that it not be fully depreciated. Councils may also decide to delay an infrastructure renewal project for a number of years simply because the effect on operational expenditure and thus rates - particularly during an economic down turn - this will show as a deficit.

The issue of sustainability was recently addressed by the Office of the Auditor General’s analysis of councils’ 2012-2022 long term plans. The Office stated:

Net income almost always stays positive, and local authorities, in the main, stay well within the golden rule of fiscal policy, that governments should borrow only to invest.

- Financial condition, as measured by both gross and net debt levels, is usually sound, with credit rating and default risk low to negligible in most local authorities.

- We found that buffer capacity is built into local authorities’ operations, partly through low debt levels and partly through their ability to meet unplanned costs through insurance and other mechanisms.

We note that local authorities are learning to leave some buffer capacity in their plans to cope with unexpected day-to-day expenditure (OAG p. 37).

It is one of the roles of the Auditor General’s Office to monitor local government financial sustainability and this includes councils’ use of debt. The OAG’s conclusion suggests that levels of debt in the local government sector are generally reasonable and that most local authorities have the ability to meet unplanned costs. It also notes that those few councils which might be at the limits of their borrowing capacity have plans to reduce their debt over the life of the current Long Term Plans.

Conclusion

The LGA 2002 requires councils to set quantifiable limits on debt and a range of approaches are employed. The most common approaches are interest payments as a proportion of total revenue; interest payments as a proportion of total rates and total debt in relation total revenue. Councils do not increase their borrowing simply because the value of their assets has increased. Borrowing is closely linked to the need to invest in new infrastructure and new existing infrastructure, meeting the inter-generational equity rule.

For further information see:

Department of Internal Affairs analysis of 2009/19 LTCCP’s

NZIER (2012) Is local government fiscally responsible

OAG (2012) Matters arising from the 2012 – 22 Long Term Plans